This is where you put in a different tax cost for each country you want to sell to.

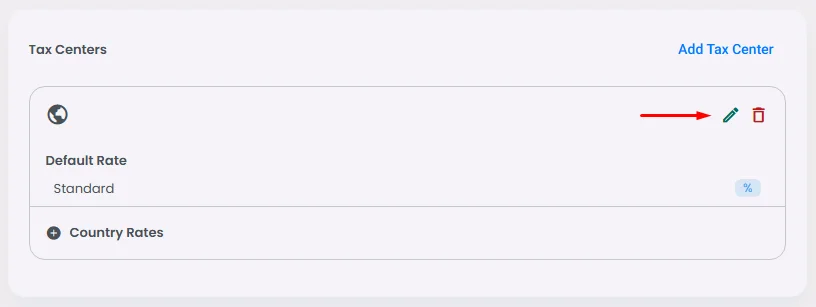

Click the edit icon.

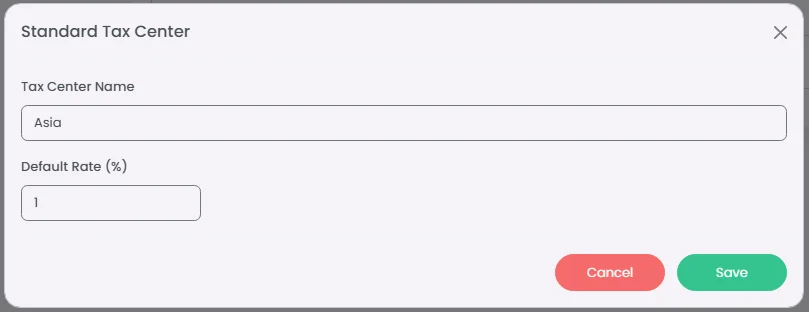

Add your tax name (e.g., Asia) and your default taxes (e.g., 1%) that will be applied in general to any country, then click ‘Save.’

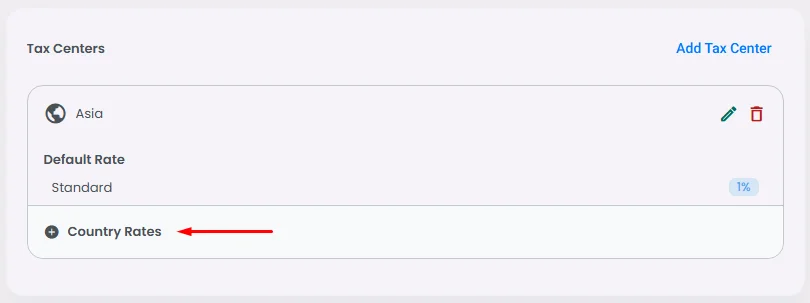

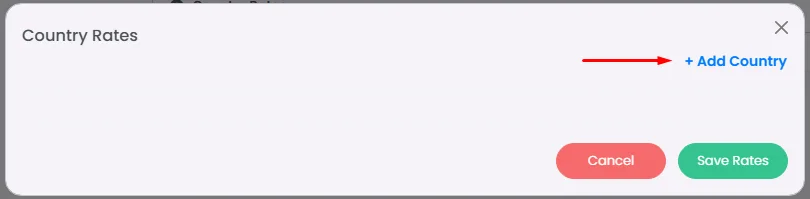

Now click ‘Country Rates.’

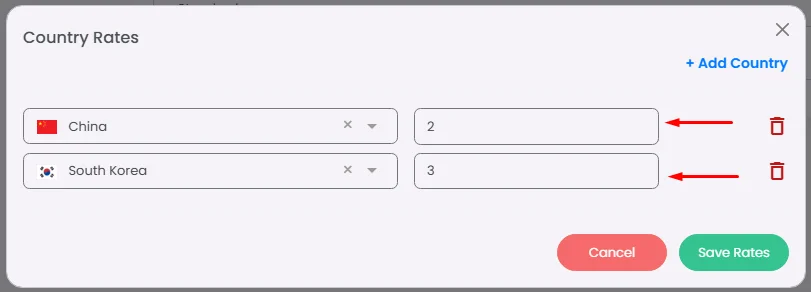

Click ‘+Add Country’ until you fill in your desired countries in Asia.

Now add the tax rate for each country.

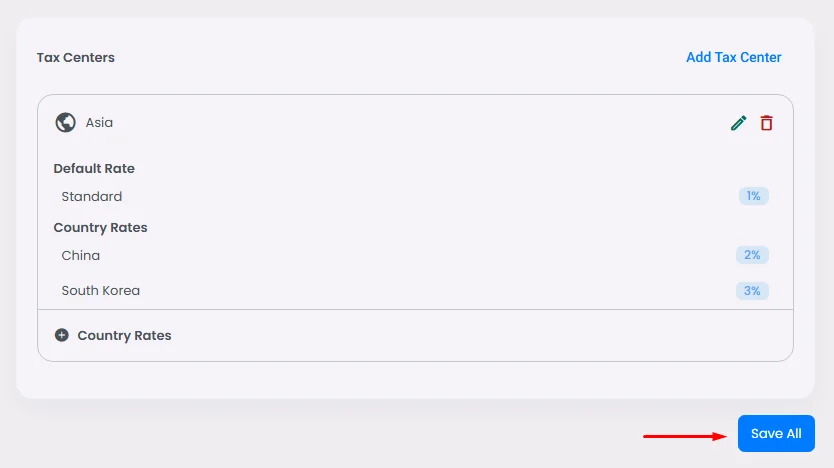

As a result, taxes will be 3% in South Korea and 2% in China. There will be a 1% tax levied on any other countries.

Don’t Forget to click ‘Save All.’

❓ FAQs

Q: How can I set different tax rates for each country in my app—without coding?

A: You can set up global and country-specific tax rates in your app using nandbox’s no-code Taxes settings. This lets you configure a default tax for all regions and easily override it for specific countries—all through a simple visual interface.

Q: How do I create tax rules?

To set up a default tax rate:

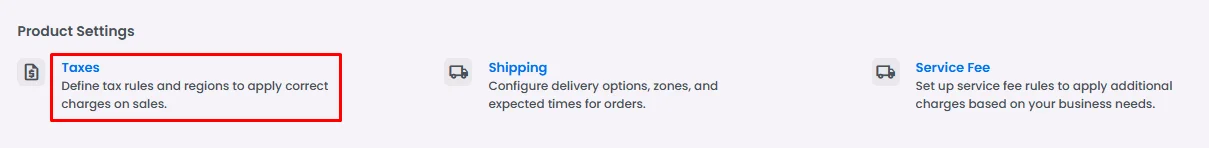

- Go to your app’s Admin Panel → Settings → Taxes

- Click the Edit icon to create or update a tax rule

- Enter a name for your tax rule (e.g., “Global Tax” or “Asia Tax”)

- Set a default tax rate (e.g., 1%)

- Click Save

This default tax rate will automatically apply to all countries unless you specify custom rates below.

Q: How do I set specific tax rates for countries?

To add country-based overrides:

- In the same Taxes screen, go to the Country Rates tab

- Click + Add Country

- Select the countries you want to configure

- For each country, enter its custom tax rate (e.g., 3% for South Korea, 2% for China)

- Click Save All to apply your changes

Countries not listed will still use your default tax rate (e.g., 1%).

Q: Why use country-specific rates?

This setup is ideal for apps that:

- Sell products globally and need to comply with local tax laws

- Run promotions with different tax handling per region

- Want full flexibility without needing a developer